An infrequent event for Wall Street’s benchmark index can be a generational opportunity for investors.

There are a lot of ways to grow your nominal wealth, including buying real estate, investing in Treasury bonds, or purchasing commodities, such as gold, silver, and oil. However, no other asset class can hold a candle to the average annual return generated by stocks over the last century.

But even though stocks are a bona fide long-term wealth creator, equities can vacillate wildly in both directions, without warning, over shorter periods.

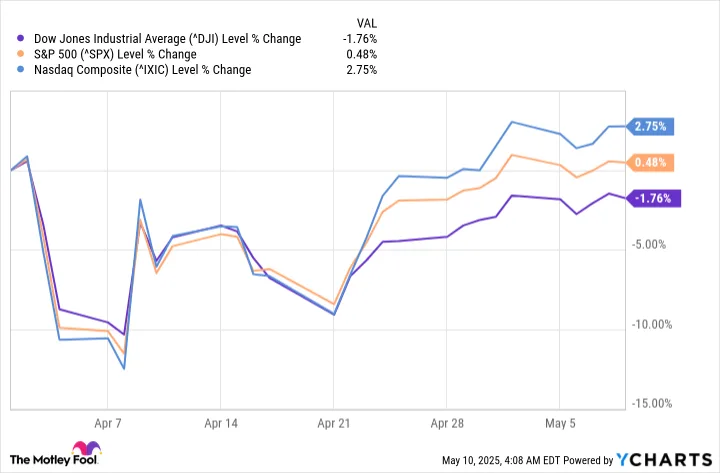

During April, investors were taken on quite the roller-coaster ride. In addition to the Dow Jones Industrial Average (^DJI 2.81%) and S&P 500 (^GSPC 3.26%) dipping into correction territory, and the Nasdaq Composite (^IXIC 4.35%) falling into a bear market, all three indexes experienced record-breaking levels of volatility.

Image source: Getty Images.

For instance, Wall Street’s benchmark index (S&P 500) endured its fifth-worst two-day percentage decline in 75 years, as well as its 12th-largest four-day decline since 1950, during the beginning of April. This was immediately followed by the Dow Jones, S&P 500, Nasdaq Composite registering their biggest single-session point increases in their respective histories on April 9.

When historic bouts of volatility occur on Wall Street, investors often seek out metrics and events that have previously occurred to uncover directional correlations. In other words, it’s perfectly normal for investors to want a competitive edge.

Although no correlative metric or event can guarantee what comes next for stocks, some of these correlations have a very high success rate of forecasting future stock returns. One such event observed in April for the S&P 500 has an immaculate track record of predicting what comes next for stocks.

Expect Wall Street’s breakneck volatility to continue for the foreseeable future

Before digging into this the S&P 500’s rare event that’s perfectly predicted the future since 1950, it’s worth noting that the multiple catalysts that led to Wall Street’s recent volatility are likely to be persistent for the foreseeable future.

At the top of the list is President Donald Trump’s tariff policy, which has upset the stock market for a variety of reasons. Following the close of trading on April 2, Trump unveiled a 10% global tariff, as well as higher “reciprocal tariffs” on dozens of countries that have historically run trade deficits with America. Though President Trump placed a 90-day pause on these reciprocal tariffs for all countries except China on April 9 — the day that led to the biggest nominal-point increase for the Dow, S&P 500, and Nasdaq in history — few trade deals have been reached, as of this writing.

Tariffs are problematic because they threaten to worsen trade relations and might incent consumers overseas to avoid American-made goods. There’s also the possibility of input tariffs increasing the cost to manufacture in the U.S., which can reignite the prevailing inflation rate.

Wall Street’s major stock indexes have been taken on a wild ride. ^DJI data by YCharts.

U.S. economic data is also whipsawing Wall Street. The initial first-quarter gross domestic product (GDP) read showed the U.S. economy shrank by 0.3%. Even though the stock market and U.S. economy aren’t tied at the hip, the first contraction in the U.S. economy in three years strongly suggests corporate earnings will be adversely impacted.

This leads to the next volatility-inducing catalyst: the stock market’s historically pricey valuation. Potentially slower corporate earnings growth at a time when stocks are exceptionally pricey isn’t a favorable combination.

In December, the S&P 500’s Shiller price-to-earnings (P/E) Ratio — this valuation tool is also known as the cyclically adjusted P/E Ratio, or CAPE Ratio — hit a high of 38.89 during the current bull market cycle. This is only the third time in 154 years (when back-tested) where the Shiller P/E has topped 38. For context, the average multiple since January 1871 is a little over 17.

More importantly, the Dow, S&P 500, and/or Nasdaq Composite have gone on to lose at least 20% of their respective value following the previous five instances of the S&P 500’s Shiller P/E surpassing 30.

Trump’s tariffs, economic uncertainty, and the stock market’s pricey valuation, aren’t going away anytime soon.

Image source: Getty Images.

An infrequent event for the S&P 500 points to a very specific directional move for stocks

With a clearer picture of what kicked off Wall Street’s wild gyrations in April, let’s turn our attention back to the benchmark S&P 500 and its history-making moment.

Most investors are probably familiar with the arbitrary lines in the sand used to describe stock market corrections and bear markets. The former occurs when an index dips at least 10% below a previous closing high. Meanwhile, a bear market represents a 20% (or greater) decline in a major stock index from a closing high.

However, there have been a series of stock market corrections for the S&P 500 since 1950 that have bordered on becoming bear markets, but never quite made it to the arbitrary decline threshold of 20%.

As you’ll note in the post below on X from Carson Group’s Chief Market Strategist Ryan Detrick, April 8 marked the trough of an 18.9% cumulative decline in the S&P 500 since it closed at an all-time high on February 19. Making the leap that this is, indeed, the low for the S&P 500, it represents the eighth time in 75 years that the benchmark index endured a near-bear market (i.e., a correction of 15% to 19.9%).

We’ve been saying for many weeks that the lows were indeed in for 2025.

As this rally continues, more are slowly coming around to that realization.

It looks like we had another near bear market correction in the 19% range. pic.twitter.com/6pLOw9tRRL

— Ryan Detrick, CMT (@RyanDetrick) May 8, 2025

What’s of interest is how stocks have responded in the wake of previous near-bear markets. Based on data Detrick gathered from FactSet, the S&P 500 was higher one, three, six, and 12 months later following the trough of all seven previous near-bear markets. That’s 28 separate data points all harmoniously pointing to the S&P 500 heading higher.

But what might be the most eyepopping of all figures associated with near-bear markets in the S&P 500 is the average return one year later. Whereas the S&P 500 has averaged a 9.2% annual return since 1950, the average return following the bottom of a near-bear market was (drum roll) 31% one year later. Stock market corrections of 15% to 19.9% have been a harbinger for outsized investment returns for 75 years!

Ryan Detrick’s post also brings to light one of Wall Street’s oddest quirks: the market’s best days (in terms of percentage returns) tend to be clustered very close to its worst days. As noted earlier, the S&P 500’s fifth-worst two-day percentage decline since 1950 was followed up by its largest nominal point gain (and eighth-biggest percentage gain) of all-time just days later.

Even though volatility can be unnerving at times — especially for newer investors who may not have navigated their way through a correction or near-bear market before — it’s the price to pay for access to the greatest wealth creator on the planet. Investors who maintain perspective can turn incidences of outsized volatility into generational opportunities.