Billionaire investor Bill Ackman has built quite the name for himself as one of the key investors to watch in the modern era. Ackman’s Pershing Square Capital Management runs a stock portfolio that owns 11 stocks valued at over $12.6 billion at the end of last year.

Through the end of 2024, his portfolio has generated a five-year return of 173%, according to the company. Due to Ackman’s concentrated portfolio and clear conviction, investors keep a close eye on his stock picks. Here are the smartest dividend stocks in Ackman’s portfolio to buy right now with $1,000.

Image source: Getty Images.

Restaurant Brands International — 3.7% dividend yield

Quick-service restaurant company Restaurant Brands International (QSR 1.18%) owns and franchises well-known fast food brands, including Tim Hortons, Burger King, Popeyes, and Firehouse Subs. These brands collectively have 32,000 restaurants in over 120 countries. Ackman has owned the stock for over a decade. Filings also indicate that he owned Burger King prior to the creation of Restaurant Brands in 2014.

In Pershing Square’s annual report, the company said it likes Restaurant Brands because of its capital-light model that generates high-margin brand royalties. Tim Horton’s has managed to grow traffic for nearly four straight years in a challenging environment, while the average franchisee saw profits increase 10% in 2024.

Restaurant Brands is also focused on a turnaround plan for Burger King U.S. Last year, the company acquired Carrols Restaurant Group, the largest franchisee of Burger King restaurants in the U.S., and is planning to remodel stores to franchise out to smaller, more local operators. Ultimately, management at Restaurant Brands is committed to growing operating profits by 8% this year, and Pershing thinks shares are trading at a sizable discount to peers.

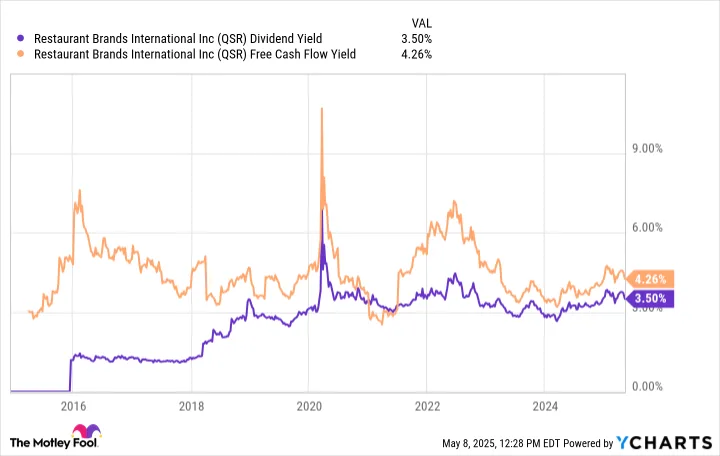

The company has been paying and growing its dividend since its formation in 2014. In 2024, total dividends of $2.48 amounted to about 78% of the company’s earnings, which actually fell about 15% year over year. The company’s trailing 12-month free cash flow yield exceeded the dividend yield during this time, so the dividend is safely covered by the company.

QSR Dividend Yield data by YCharts.

Nike — 2.7% dividend yield

Ackman and Pershing acquired a stake in Nike (NKE 6.79%) in the spring of 2024, betting on a turnaround story for the iconic footwear and apparel brand that has fallen on hard times. Nike’s stock is down about 34% over the last five years and about 18.5% this year. The company got into trouble when it began to focus on promotional online sales to consumers, instead of focusing on its proven wholesale partnership model.

In September 2024, Nike’s board hired the 30-plus-year veteran Elliott Hill out of retirement to become CEO and lead the turnaround. Hill has to correct some of Nike’s mistakes over the last few years and must change the strategic direction of the company. Competition from luxury brands in the footwear and apparel space have taken market share from Nike. To be successful, Hill needs to remind investors of Nike’s leadership in marketing and product innovation, which is what made Nike an iconic brand over many decades.

NKE Dividend Yield data by YCharts.

The challenges are not small, and analysts warn that the turnaround could take longer than expected, but Ackman sees a brand that will always be relevant, leaving time on his side.

Meanwhile, Pershing can collect a 2.7% dividend yield, which looks well protected. Nike has increased its quarterly dividend rate for 23 consecutive years. Dividends are being well covered by earnings, and trailing 12-month free cash flow yield is more than double the dividend yield.