U.S. President Donald Trump has lived up to his promise of making tariffs a big issue. Regardless of your opinion of his tactic, the world has to deal with the fallout. It’s unclear where the chips are going to land at this point in time.

One way to deal with the uncertainty is to increase diversification, specifically by adding foreign stocks to the mix. A quick and easy way to do that is to buy the Vanguard International High Dividend Yield ETF (VYMI -0.31%).

Here’s what you need to know.

Why you need to consider foreign investing

Most investors buy what they know, which usually means focusing on companies that have material operations in the countries where they live. So, U.S. investors often have a huge overweight in U.S. companies. That’s not shocking, but it means that investors may want to think about the bigger picture.

Image source: Getty Images.

The U.S. only accounts for around 25% of global gross domestic product (GDP). That’s a huge percentage, to be sure, but it’s nowhere near the only country that matters when it comes to investing. If you don’t make an effort to specifically invest in some foreign stocks, you’ll miss out on a vast swath of the investment opportunity you have in front of you.

To be fair, there are large multinational companies that operate out of the United States. So you probably have some indirect exposure to foreign markets in your portfolio already. Many foreign companies sell into the U.S. market, so there’s overlap the other way, too.

But specifically adding foreign stocks will materially increase portfolio diversification. Notably, it could help soften the effect of tariff changes since trade between other countries will change in different ways than trade between the U.S. and foreign countries will change.

While you could attempt to cherry-pick individual foreign stocks, it’s probably a better idea to use an exchange-traded fund (ETF) to handle this part of your portfolio. The Vanguard International High Dividend Yield ETF is a simple, quick, and high-yield solution.

What does the Vanguard International High Dividend Yield ETF do?

The goal of the Vanguard International High Dividend Yield ETF is to provide “a convenient way to get exposure to international stocks that are forecasted to have above-average dividend yields.” The index the ETF tracks is the FTSE All-World ex US High Dividend Yield Index. That makes complete sense, given the goal.

The FTSE All-World ex US High Dividend Yield Index starts with the FTSE All-World Index, and then eliminates real estate investment trusts (REITs) and any company that’s expected to pay no dividends over the next 12 months. The stocks that remain are then lined up from the highest yield to the lowest yield. After that, stocks are added to the index until the “cumulative market capitalization reaches 50% of the total market cap of this universe of stocks.” That’s not exactly the same as saying the top 50% get into the index, but effectively, the Vanguard International High Dividend Yield ETF owns the largest and most important high-yield stocks.

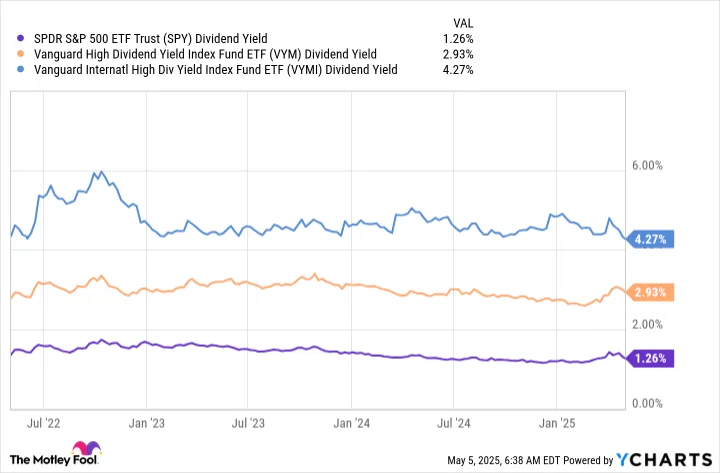

SPY Dividend Yield data by YCharts.

The expense ratio for the ETF is a fairly reasonable 0.17%, since it costs more to operate across different countries than it would to operate in just the U.S. market. The portfolio’s more than 1,500 holdings are spread across Europe (about 44% of assets), the Pacific (26%), emerging markets (21%), North America (7%), and the Middle East (the remainder). There is a lot of diversification on offer here.

The dividend yield is also fairly attractive, at 4.4%. That’s well above the 1.2% yield on offer from the S&P 500 index and the 2.8% yield you’d get with the U.S. version of this ETF, the Vanguard High Dividend Yield ETF. So not only are you adding diversification, you’re also adding income.

What the Vanguard International High Dividend Yield ETF can and can’t do

Adding the Vanguard International High Dividend Yield ETF won’t fully protect you from tariff uncertainty. There’s really no investment that can easily do that. But the Vanguard International High Dividend Yield ETF can help lessen the risk you face from tariff changes by providing exposure to high-yield stocks that will likely perform differently from U.S. stocks.

That diversification benefit will remain, even if the tariff upheaval amounts to nothing in the end. But don’t forget that you’ll be adding extra yield to the mix, so even in that situation, dividend investors will still end up better off.

1 Comment

Pingback: Is It Time to Buy the Vanguard International High Dividend Yield ETF? – TFFH – The Financial Freedom Hub – TFFH – The Financial Freedom Hub