In today’s fast-paced financial landscape, leveraging specialized AI agents to handle discrete aspects of analysis is key to delivering timely, accurate insights. Agno’s lightweight, model-agnostic framework empowers developers to rapidly spin up purpose-built agents, such as our Finance Agent for structured market data and Risk Assessment Agent for volatility and sentiment analysis, without boilerplate or complex orchestration code. By defining clear instructions and composing a multi-agent “Finance-Risk Team,” Agno handles the coordination, tool invocation, and context management behind the scenes, enabling each agent to focus on its domain expertise while seamlessly collaborating to produce a unified report.

!pip install -U agno google-genai duckduckgo-search yfinanceWe install and upgrade the core Agno framework, Google’s GenAI SDK for Gemini integration, the DuckDuckGo search library for querying live information, and YFinance for seamless access to stock market data. By running it at the start of our Colab session, we ensure all necessary dependencies are available and up to date for building and running your finance and risk assessment agents.

from getpass import getpass

import os

os.environ["GOOGLE_API_KEY"] = getpass("Enter your Google API key: ")The above code securely prompts you to enter your Google API key in Colab without echoing it to the screen, and then it is stored in the GOOGLE_API_KEY environment variable. Agno’s Gemini model wrapper and the Google GenAI SDK can automatically authenticate subsequent API calls by setting this variable.

from agno.agent import Agent

from agno.models.google import Gemini

from agno.tools.reasoning import ReasoningTools

from agno.tools.yfinance import YFinanceTools

agent = Agent(

model=Gemini(id="gemini-1.5-flash"),

tools=[

ReasoningTools(add_instructions=True),

YFinanceTools(

stock_price=True,

analyst_recommendations=True,

company_info=True,

company_news=True

),

],

instructions=[

"Use tables to display data",

"Only output the report, no other text",

],

markdown=True,

)

agent.print_response(

"Write a report on AAPL",

stream=True,

show_full_reasoning=True,

stream_intermediate_steps=True

)

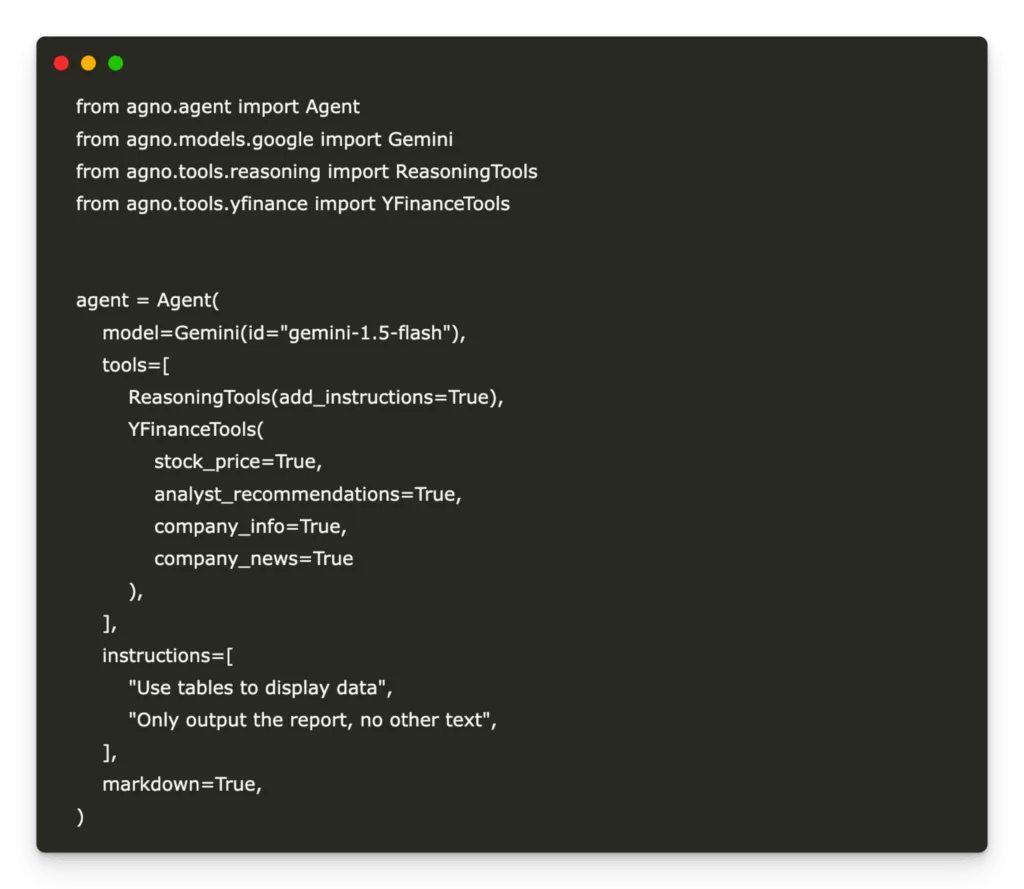

We initialize an Agno agent powered by Google’s Gemini (1.5 Flash) model, equip it with reasoning capabilities and YFinance tools to fetch stock data, analyst recommendations, company information, and news, and then stream a step-by-step, fully transparent report on AAPL, complete with chained reasoning and intermediate tool calls, directly to the Colab output.

finance_agent = Agent(

name="Finance Agent",

model=Gemini(id="gemini-1.5-flash"),

tools=[

YFinanceTools(

stock_price=True,

analyst_recommendations=True,

company_info=True,

company_news=True

)

],

instructions=[

"Use tables to display stock price, analyst recommendations, and company info.",

"Only output the financial report without additional commentary."

],

markdown=True

)

risk_agent = Agent(

name="Risk Assessment Agent",

model=Gemini(id="gemini-1.5-flash"),

tools=[

YFinanceTools(

stock_price=True,

company_news=True

),

ReasoningTools(add_instructions=True)

],

instructions=[

"Analyze recent price volatility and news sentiment to provide a risk assessment.",

"Use tables where appropriate and only output the risk assessment section."

],

markdown=True

)

These definitions create two specialized Agno agents using Google’s Gemini (1.5 Flash) model: the Finance Agent fetches and tabulates stock prices, analyst recommendations, company info, and news to deliver a concise financial report, while the Risk Assessment Agent analyzes price volatility and news sentiment, leveraging reasoning tools where needed, to generate a focused risk assessment section.

from agno.team.team import Team

from textwrap import dedent

team = Team(

name="Finance-Risk Team",

mode="coordinate",

model=Gemini(id="gemini-1.5-flash"),

members=[finance_agent, risk_agent],

tools=[ReasoningTools(add_instructions=True)],

instructions=[

"Delegate financial analysis requests to the Finance Agent.",

"Delegate risk assessment requests to the Risk Assessment Agent.",

"Combine their outputs into one comprehensive report."

],

markdown=True,

show_members_responses=True,

enable_agentic_context=True

)

task = dedent("""

1. Provide a financial overview of AAPL.

2. Provide a risk assessment for AAPL based on volatility and recent news.

""")

response = team.run(task)

print(response.content)We assemble a coordinated “Finance-Risk Team” using Agno and Google Gemini. It delegates financial analyses to the Finance Agent and volatility/news assessments to the Risk Assessment Agent, then synthesizes their outputs into a single, comprehensive report. By calling team.run on a two-part AAPL task, it transparently orchestrates each expert agent and prints the unified result.

team.print_response(

task,

stream=True,

stream_intermediate_steps=True,

show_full_reasoning=True

)

We instruct the Finance-Risk Team to execute the AAPL task in real time, streaming each agent’s internal reasoning, tool invocations, and partial outputs as they happen. By enabling stream_intermediate_steps and show_full_reasoning, we’ll see exactly how Agno coordinates the Finance and Risk Assessment Agents step-by-step before delivering the final, combined report.

In conclusion, harnessing Agno’s multi-agent teaming capabilities transforms what would traditionally be a monolithic AI workflow into a modular, maintainable system of experts. Each agent in the team can specialize in fetching financial metrics, parsing analyst sentiment, or evaluating risk factors. At the same time, Agno’s Team API orchestrates delegation, context-sharing, and final synthesis. The result is a robust, extensible architecture ranging from simple two-agent setups to complex ensembles with minimal code changes and maximal clarity.

Check out the Colab Notebook. Also, don’t forget to follow us on Twitter and join our Telegram Channel and LinkedIn Group. Don’t Forget to join our 90k+ ML SubReddit. For Promotion and Partnerships, please talk us.

Asif Razzaq is the CEO of Marktechpost Media Inc.. As a visionary entrepreneur and engineer, Asif is committed to harnessing the potential of Artificial Intelligence for social good. His most recent endeavor is the launch of an Artificial Intelligence Media Platform, Marktechpost, which stands out for its in-depth coverage of machine learning and deep learning news that is both technically sound and easily understandable by a wide audience. The platform boasts of over 2 million monthly views, illustrating its popularity among audiences.