GDP is a measure of output from the spending side. A standard alternative measure is Gross Domestic Output (GDO), the average of GDP and GDI.

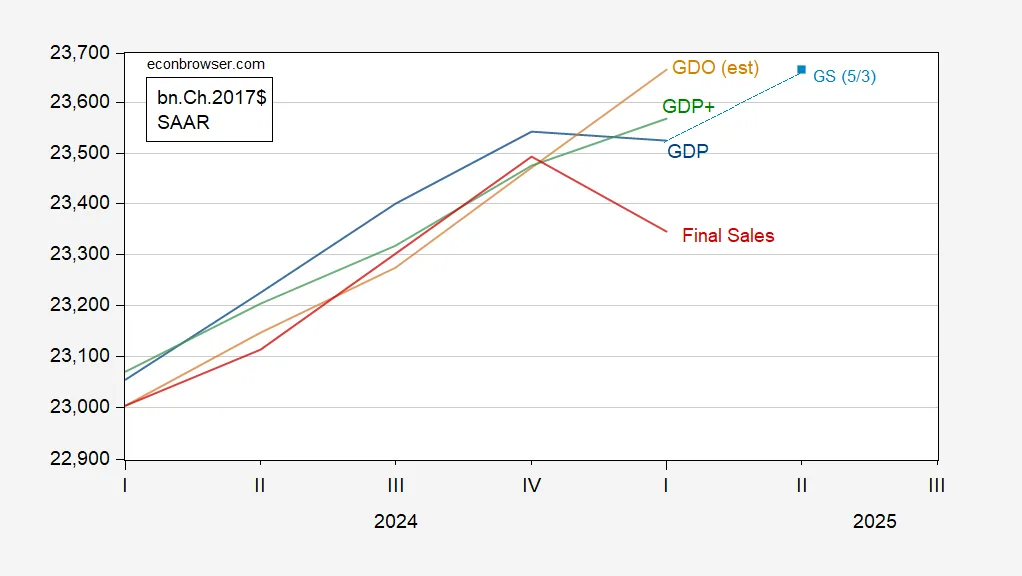

Figure 1: GDP (blue), Goldman Sachs tracking estimate of 53 (light blue square), estimate of GDO (tan), GDP+ (green), and final sales (red), all in bn.Ch.2017$ SAAR. Estimate of GDO calculated by using assuming 12.8% increase in net operating surplus, y/y. GDP+ calculated by iterating growth rates on 2021Q4 level of GDP. Source: BEA 2025Q1 advance, Goldman Sachs, Philadelphia Fed, and author’s calculations.

The increase in net operating surplus is estimated by applying a 12.9% estimated increase in corporate profits to 2024Q1 net operating surplus.

Goldman Sachs notes:

we believe inventory investment was significantly understated, which means that GDP was significantly understated too.

We expect this distortion to reverse in Q2. Our current forecast of +2.4% assumes that measured imports decline sharply but measured inventory investment remains solid as the distortion unwinds. However, this is highly uncertain, in part because the distortion could also unwind via upward revisions to Q1 GDP.

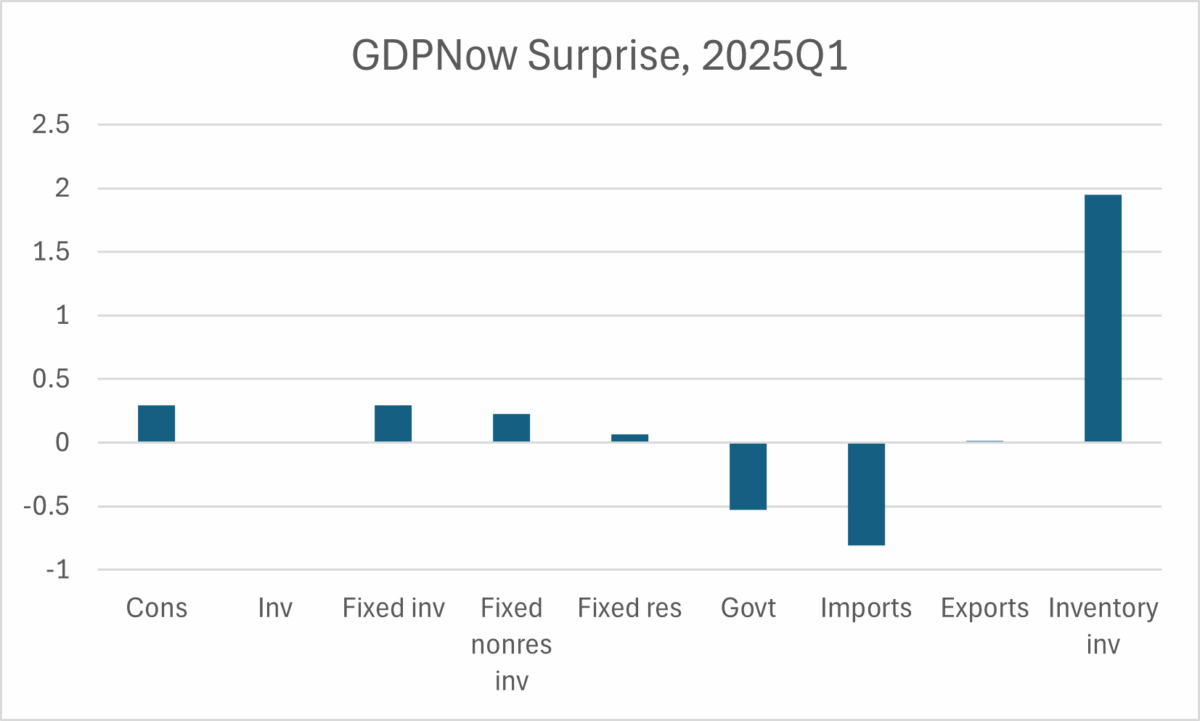

The miss in inventory investment is manifested in the miss in GDPnow (the last nowcast was for -1.5%, while advance estimate was -0.3%).

Figure 2: Forecast error in contribution to real GDP growth, % q/q AR from consumption, investment, fixed investment fixed nonresidential investment, fixed residential investment, government, imports, exports, inventory investment. Imports shown as negative of contribution. Source: BEA 2025Q1 advance release, Atlanta Fed, and author’s calculations.

The (absolute value of the) contribution of imports was underpredicted by 0.8 ppts, while the underprediction of inventory investment was 1.9 ppts. The entire miss in imports was on the goods side.

Final sales is way down (while final sales to private domestic purchasers is still growing smartly, around 2% q/q AR).