Prepping slides for macro, found these interesting correlations.

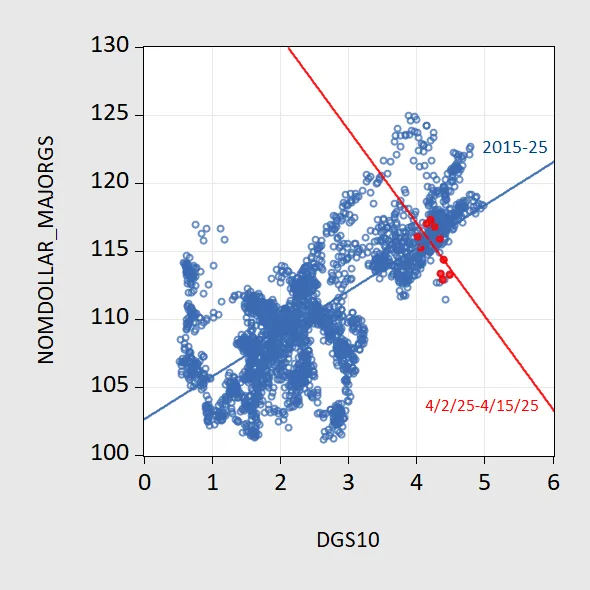

First, how the strength of the dollar correlates with the Treasury 10 year yield, daily 2015-23 April 2025.

Figure 1: Nominal dollar index vs. basket of major country currencies (blue circles), and OLS fit (blue line), and observations for 4/2/2025-4/15/2025 (red circles). Source: Fed and Treasury via FRED, and author’s calculations.

In the two weeks around Liberation Day, Treasury 10 year yields rose as the dollar fell (red circles in Figure 1).

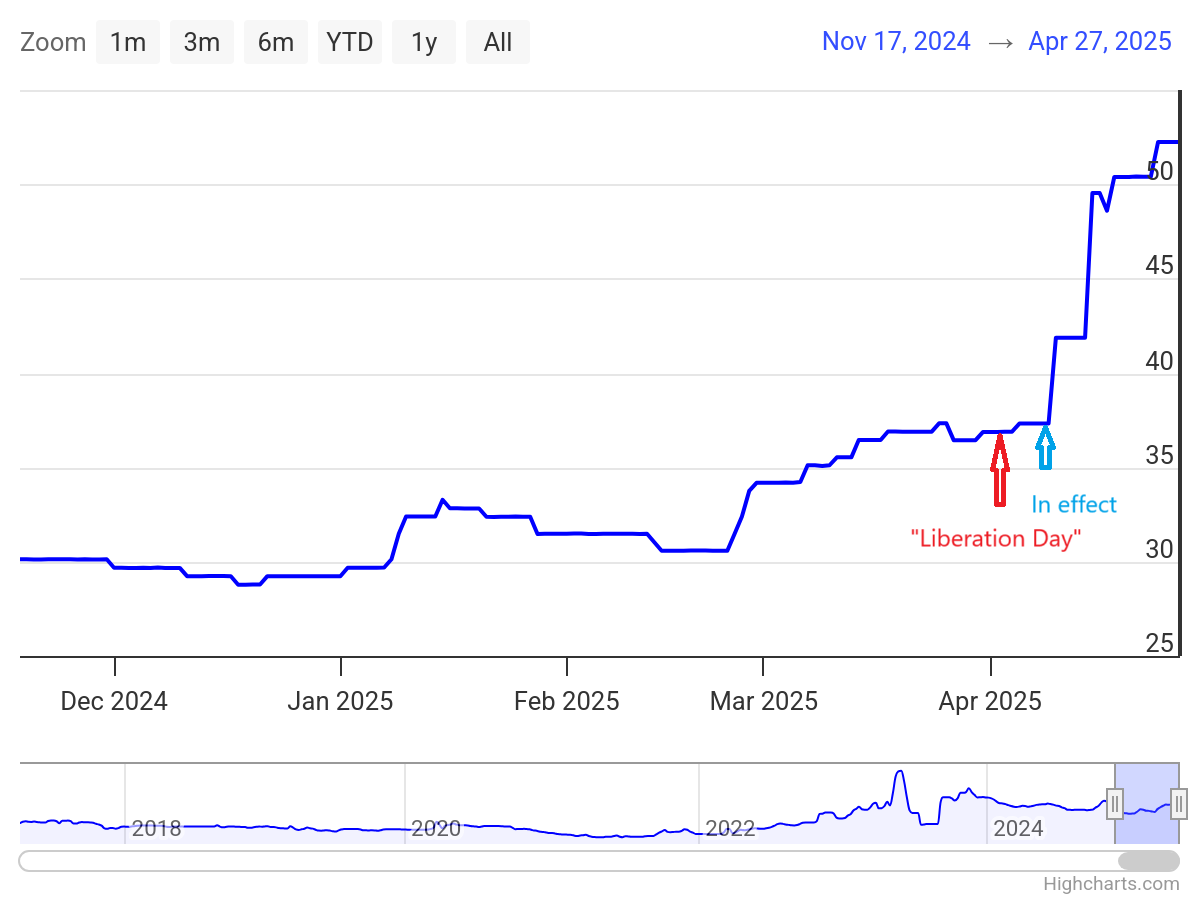

One obvious place to look for a loss in credibility is in credit ratings; however, those are notoriously sticky. I looked at credit default swap spreads, and was surprised, as I thought only in emerging market economies in crisis did I see noticeable movements — such as those since April 2, “Liberation Day”.

Source: worldgovernmentbonds.com, annotated by author.

Large movements only in the context of the US. To quote:

As of the latest update on 27 Apr 2025 13:45 GMT+0, the United States 5 Years Credit Default Swap (CDS) value stands at 52.25 basis points. This CDS value translates to an implied probability of default of 0.87%, based on a presumed recovery rate of 40%.

All I can say is, thanks Trump!