Emergency Fund for Young Professionals – Behavioral Economics Barriers to Emergency Fund Creation

Psychological and Behavioral Barriers

Emergency fund for young professionals? Let’s go!

Behavioral economics studies identify several psychological and behavioral barriers that impede young professionals from building emergency funds. Key barriers include present bias (the tendency to prioritize immediate consumption over future savings), low financial confidence, and limited financial knowledge. Present bias leads individuals to undervalue the importance of future financial security, resulting in insufficient emergency savings. Overconfidence or underconfidence in financial decision-making can also deter proactive saving behaviors, as individuals may either overestimate their ability to handle emergencies or feel overwhelmed by financial planning tasks. Social norms and risk perception further influence saving behaviors, with some individuals perceiving emergency funds as unnecessary or unattainable due to their social environment or perceived low risk of emergencies (Nwosu and Ilori, 2024).

Structural and Access Barriers

Access to financial products, such as savings accounts, is a significant structural barrier. Studies show that savings account ownership is the strongest predictor of having an emergency fund, increasing the likelihood by 25% to 29% (Despard, Friedline and Martin-West, 2020). Without easy access to appropriate financial tools, young professionals may find it difficult to set aside money for emergencies. Additionally, income level plays a crucial role; those with higher incomes are more likely to accumulate larger emergency funds, while lower-income individuals face greater challenges in both starting and growing their savings (Nguyen, 2023).

Financial Literacy and Capability

While objective financial knowledge alone does not consistently predict emergency fund ownership, subjective financial knowledge (how knowledgeable individuals feel) and financial confidence are significant factors (Despard, Friedline and Martin-West, 2020; Babiarz and Robb, 2014). Financial behavior – such as budgeting, tracking expenses, and setting savings goals – has a direct impact on the likelihood and adequacy of emergency fund accumulation. In developing countries, financial behavior and income level are particularly important, with income being the primary determinant of the size of emergency funds (Nguyen, 2023).

Want to read more about budgeting basics and personal finance skills? Click here!

Solutions and Behavioral Science-Backed Strategies

Nudges and Automated Tools

Behavioral interventions, such as automated savings plans and real-time spending alerts, can help overcome present bias and inertia. For example, models that use transaction data to create personalized spending and deposit plans, combined with early warning mechanisms, have been shown to increase emergency fund savings compared to scenarios without planning (Liu et al., 2023). These tools leverage behavioral insights by making saving easier and more automatic, reducing the cognitive load on individuals.

Financial Education and Confidence Building

Programs that focus on increasing subjective financial knowledge and confidence, rather than just objective knowledge, are more effective in promoting emergency fund creation (Despard, Friedline and Martin-West, 2020; Babiarz and Robb, 2014). Financial educators and counselors can help young professionals develop practical skills, such as budgeting and goal-setting, and foster a sense of financial self-efficacy.

Access and Incentives

Expanding access to short-term savings products and providing incentives – such as employer-sponsored emergency savings accounts or government-backed savings programs – can address structural barriers. Policies that encourage savings account ownership and provide financial slack (extra resources for saving) are particularly effective (Despard, Friedline and Martin-West, 2020).

Social Norms and Peer Influence

Interventions that leverage social norms, such as public commitments to save or peer comparison tools, can motivate young professionals to prioritize emergency fund creation. By normalizing the behavior and making it visible, these strategies can counteract the perception that saving is unattainable or unnecessary (Nwosu and Ilori, 2024).

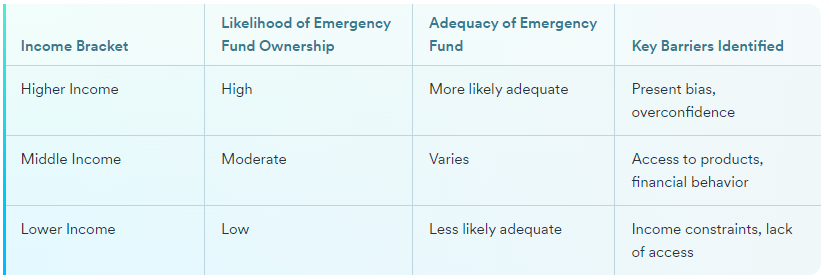

Comparison of Savings Rates Across Income Brackets

Research consistently finds that income level is a major determinant of both the likelihood of having an emergency fund and the size of that fund. Higher-income individuals are more likely to have adequate emergency savings, while those in lower income brackets face greater barriers and are less likely to have funds sufficient to cover three months of expenses (Nguyen, 2023). This disparity highlights the need for targeted interventions that address both behavioral and structural barriers for lower-income young professionals.

(Despard, Friedline and Martin-West, 2020; Babiarz and Robb, 2014; Nguyen, 2023)

Read more of our Personal Finance Basics & Budgeting guides here!

Conclusion

Behavioral economics research reveals that both psychological and structural barriers hinder young professionals from building emergency funds. Effective solutions include automated savings tools, confidence-building financial education, expanded access to savings products, and interventions that leverage social norms. Addressing these barriers is especially important for lower-income individuals, who face the greatest challenges in emergency fund creation and adequacy (Liu et al., 2023; Despard, Friedline and Martin-West, 2020; Babiarz and Robb, 2014; Nguyen, 2023; Nwosu and Ilori, 2024).

References

- Liu, J., Huang, S., Fu, Q., Luo, Y., Qin, S., Cao, Y., Zhai, J., & Yang, S., 2023. The open banking era: An optimal model for the emergency fund. Expert Syst. Appl., 244, pp. 122915. https://doi.org/10.1016/j.eswa.2023.122915

- Despard, M., Friedline, T., & Martin-West, S., 2020. Why Do Households Lack Emergency Savings? The Role of Financial Capability. Journal of Family and Economic Issues, 41, pp. 542 – 557. https://doi.org/10.1007/s10834-020-09679-8

- Babiarz, P., & Robb, C., 2014. Financial Literacy and Emergency Saving. Journal of Family and Economic Issues, 35, pp. 40-50. https://doi.org/10.1007/S10834-013-9369-9

- Nguyen, T., 2023. The power of financial behavior in emergency funds: Empirical evidence from a developing country. Journal of Eastern European and Central Asian Research (JEECAR). https://doi.org/10.15549/jeecar.v10i3.1223

- Nwosu, N., & Ilori, O., 2024. Behavioral finance and financial inclusion: A conceptual review and framework development. World Journal of Advanced Research and Reviews. https://doi.org/10.30574/wjarr.2024.22.3.1726