UBS analyst Amit Mehrotra recently added Honeywell International (HON -0.72%) to his list of “top picks,” which also includes industrials Johnson Controls (JCI 0.72%) and 3M (MMM 0.97%). All three have substantive potential to outperform, and these are the stocks investors should be looking at now.

Honeywell International: Near- and long-term potential

Simply put, Honeywell has the potential to outperform over the near and long term. The company has already reported on its first quarter, and management raised the midpoint of its full-year guidance based on an excellent set of results. Moreover, the guidance incorporates assumptions for the current level of tariffs.

Of particular note is that its aerospace business benefits from the ongoing ramp-up in aircraft production, growth in flight departures, and building automation. Discussing the latter on the earnings call, CFO Mike Stepniak said, “second consecutive quarter of above double-digit growth in Building Solutions and mid-single-digit growth in Building Products.” I’ll come back to this point when discussing Johnson Controls.

There are areas of weakness, such as industrial automation, where customers are reacting negatively to the uncertainty around tariffs, but overall, Honeywell’s full-year outlook for 2% to 5% organic sales growth is positive in the current environment.

Image source: Getty Images.

In the long term, Honeywell’s businesses have upside potential from the forthcoming breakup into three divisions. In particular, Honeywell Aerospace will likely benefit from an increased ability to raise capital and present a more focused investment proposition to investors. Honeywell Automation can benefit from a tighter strategic focus as management looks to take advantage of the digital web-enabled opportunity ahead in industrial and building automation.

It’s a compelling mix and makes Honeywell an excellent stock for near- and long-term-focused investors.

Johnson Controls: An undervalued stock

Honeywell competes with Johnson Controls in building automation, and the strength in Honeywell’s building automation business reads well for Johnson Controls. The company recently released its fiscal second-quarter 2025 earnings results, for the period ended March 31, and reported organic sales growth of 7%. It promptly raised its full-year earnings guidance to $3.60 from a previous range of $3.50 to $3.60, a significant plus in the current environment.

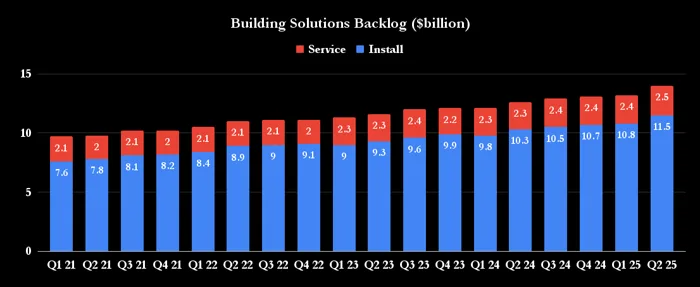

Moreover, the 5% order growth helped Johnson Controls increase its backlog to $14 billion. The chart below demonstrates the ongoing growth in installed equipment and services, driven by the increasing deployment of digital technology in its solutions.

Data source: Johnson Controls presentation. Chart by author.

The company has a number of long-term growth catalysts in its favor, including the added value inherent in the increasing adoption of its OpenBlue suite of web-connected solutions. This suite uses digital technology (artificial intelligence and digital twins) to optimize building efficiency. Not only does this save money, but it also helps building owners meet their net-zero emissions goals.

In addition, Johnson Controls’ heating, ventilation, and air conditioning systems have a growth opportunity from their use to control temperatures in data centers, making the company a backdoor way to play the AI/data center spending boom.

3M: A self-help story

3M’s relatively new CEO, Bill Brown (appointed in May 2024), is already driving improvements at a company that has been underperforming for some time. Previous management’s handling of the company’s ongoing legal issues burdened it. In addition, an underperforming healthcare business (now spun off as Solventum) didn’t see any significant improvement despite substantive mergers and acquisitions activity, which was also a distraction from its core industrial and consumer businesses.

With Solventum now spun off and previous management’s restructuring actions starting to bear fruit, it was time for a new CEO to take the next step and rejuvenate the company to its former glory.

The early signs are good. Brown is driving growth in new product introductions (NPIs) while making blocking and tackling operational improvements like improving its on-time in full deliveries, asset utilization, and operating efficiency. These improvements have come even as 3M’s end markets have weakened in 2025, and management believes it is now tracking toward the low end of its guidance for full-year organic sales growth of 2% to 3%.

While that’s disappointing, readers should note that the operational improvements helped 3M grow its operating margin to 23.5% in the first quarter compared to 21.3% in the same period of last year.

As such, if the tariff environment improves, 3M could see a triple positive impact: improved end markets, fewer cost headwinds from tariffs, and likely enhanced earnings as the improved margin performance impacts the bottom line. It’s a compelling mix that makes the stock attractive on a risk/reward basis.